What Will Tesla Deliver In Q4?

Summary

Management looking for about 27,000 S/X deliveries.

Will Model 3 finally break into the thousands?

What other data will Tesla provide?

Next week, we'll get an update from Tesla (TSLA) on its Q4 2017 deliveries and production. This will likely be the second to last major chapter of the company's story for this year, which due to multiple delays and large losses should be considered a failure. Today, I'll look at where estimates stand and what investors should be looking for in next week's report.

Back in October, and later reiterated on the Q3 earnings report, management called for about 100,000 deliveries of the Model S and X in 2017. Through the first three quarters of 2017, the company was around 73,000 deliveries of those two models, meaning Tesla expected to deliver around 27,000 units in Q4. The company was looking to lower its inventory on hand, cutting production of these two into the 1,800 to 2,000 per week range. Remember, a year ago Tesla was supposed to be above 2,400 units per week, but it still hasn't gotten there. It may never do so at these price points, and the selling of inventory units will impact average selling prices in the period.

There are a variety of sites out there that provide estimates for Tesla deliveries, mainly InsideEvs and Tesla Motors Club. These two sites provide figures for the United States as well as Europe, and are quoted by those looking to see what Tesla does in the earlier months of a quarter. By the time they report all of their final month of the quarter numbers, Tesla has usually provided its quarterly figures. Here's some key data so far:

- July and August - 9,200 deliveries between US/Europe.

- September and October - 9,380 deliveries in these regions.

The final month of each quarter is usually when Tesla delivers a lot of vehicles, meaning early quarter data can be dwarfed by a large or small final month. There is positive data coming out of Norway, putting Tesla at 2,366 registrations through December 27th, compared to just over 2,000 in that country during September. That likely puts Norway on pace for about 500 extra deliveries in Q4's final month as compared to Q3's final month.

If there is any bad news here, it was that the first two months of Q4 in the US saw just 5,180 deliveries of the S/X compared to 6,800 in the first two months of Q3. Tesla saw estimated US deliveries of just under 8,000 in September, but if sales drop by a similar 25% to what we saw in October and November, that will make it very tough to get to the 27,000 management was looking for.

US deliveries in December could swing wildly based on a few factors. First, they may have slowed as consumers were waiting for the Model 3, although that delay could have caused some to go for the S instead. Additionally, some may have thought the elimination of the $7,500 tax credit in the tax bill, a credit that was later saved, was reason enough to jump in for the S/X. On the other hand, if production was slowed and a large number of units were ones that ended up in Norway/Europe, US sales could see similar slowdowns to prior months. Tesla delivered a little under 26,000 Model S/X in Q3, so a good range to look at is 26,500 to 27,500 in Q4.

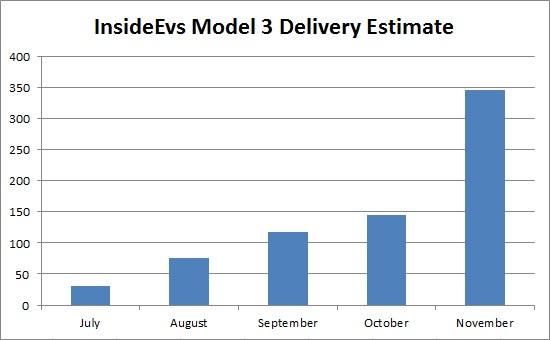

Investors, however, may completely ignore the Model S/X number based on what Tesla says regarding the Model 3. The company announced a paltry 220 deliveries during Q3, well below of its official guidance for around 1,500 and Elon Musk's aspiration for 100,000 to 200,000 production units in the second half of the year. InsideEvs estimated that 490 Model 3 units were delivered in October and November. Tesla pushed back its 5,000 per week production figure by three months at the Q3 earnings report, so Model 3 progress is very low.

There have been numerous articles on pro-Tesla site electrek detailing how Model 3 deliveries were likely ramping up in a big way in December. However, just seeing pictures of vehicles sitting in a lot doesn't tell you anything if they need more work or can't be picked up before the end of the month. One Tesla analyst recently cut his estimates, based on 5,000 Model 3 units being delivered in the period, below sell-side figures, and down from his previous forecast for 15,000. If Tesla delivers five times as many Model 3s in December as it did in November, it would put the quarterly figure at 2,215 if we use InsideEvs number for the first two months of the period. Given how I remain skeptical due to Tesla's continued production problems, I think a range of 1,500 to 2,500 is an appropriate one for investors to watch.

It also will be interesting to see what other information Tesla provides, like the number of vehicles in-transit (other than Model 3 is key for this). While I expect guidance to be reiterated for 5,000 units of weekly Model 3 production by the end of Q1 (or for nothing to be said on this front), it will be interesting to see what the current production rate is. Did things get to the thousands like Musk said they would on the conference call?

Barring a dramatic falloff in Tesla sales during December, the one thing we are pretty much guaranteed to hear next week is that Tesla hit a quarterly record for deliveries. Based on numbers we've seen so far, anything under 28,000 total deliveries would be pretty bearish, while over 30,000 would likely be a welcome sign. I'm sure investors will focus more on the Model 3, even though the S/X are more critical to the financials in the short term. What are your thoughts for S/X/3 numbers in Q4? I look forward to your thoughts in the comments below.

Comments

Post a Comment